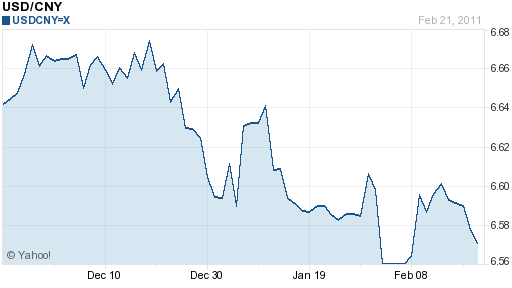

Still, I wondered whether the move was aimed as a political sop designed to appease Western countries, rather than a meaningful change in China’s forex policy. My suspicions were confirmed on Monday, when the markets opened, and the RMB jumped by a pathetic .4%. All of those who had been hoping for an expecting an instant revaluation a la the 5% jump in 2005 were sadly disappointed.

Most commentators shared my cynicism about the move. According to Goldman Sachs Group Chief Global Economist Jim O’Neill, ” ‘It’s pretty astute timing. The timing of it is clearly aimed at the G-20 meeting, which indirectly links to the whole renewed thrust in Congress with protectionist steps against China.’ ” If this was in fact China’s intention, it backfired, since it only succeeding only in bringing increased attention to the still-undervalued Yuan. Senator Sherrod Brown called the appreciation ” ‘a drop in a huge bucket….We’ve seen China take actions like this before when the spotlight is on, and then revert back to old tricks.” Thus, he and Senator Charles Schumer have announced that they will move forward with a bill to punish China, unless the RMB is allowed to significantly appreciate.

By the Central Bank of China’s own admission, this is unlikely. Instead, it will continue to “keep the renminbi exchange rate at a reasonable and balanced level of basic stability.” In other words, the RMB is still pegged squarely to the US Dollar. It is neither freely floating nor is it pegged to a basket of currencies (in which case it could conceivably appreciate faster against the Dollar, due to the weak Euro). It is technically allowed to rise and fall on a daily basis within a .5% ban, but even this is controlled tightly by the Central Bank, via the so-called Central Parity Rate. If the rate fluctuates too much, state-owned companies often intervene in the markets at the behest of the Central Bank. Legitimate market participants are heavily constrained by a rule that requires them to square all of their positions at the end of every trading session, such that making long-term bets on the RMB’s appreciation would be impossible.

Not that it matters. In the US, where it is legal to make long-term bets on the RMB (via futures contracts), investors are still only projecting a 1.8% appreciation (2.2% relative to the RMB’s pre-revaluation level) over the next year, and a 2.9% appreciation by the end of 2011. In the end, there just isn’t a lot of confidence that China will voluntarily act in a way that is contrary to its own short-term economic interests.

0 comments: