Recently, it struck me: the US does not care about the Dollar. If you look at fiscal and monetary policy, there is actually a remarkable degree of consistency. Both reflect a clear disregard for the conditions that are necessary for a strong currency.

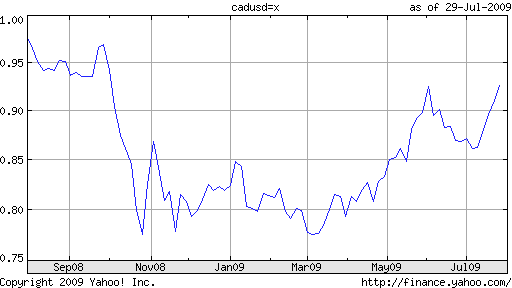

This might seem ridiculous, given the Dollar’s amazing performance of late. It has appreciated healthily against almost all of the world’s major currencies, and is also more valuable on a trade-weighted basis. Bear in mind, however, that this rise is entirely a function of the (perceived) crisis in Europe. It speaks not to any strength in the Dollar, but rather to weakness in other currencies. In fact, as I wrote earlier this week (“US Dollar Paradigm Shift“), as investors have returned their gaze to the fundamentals, the Dollar has suffered.

Without drilling into the nuts and bolts of US fiscal policy, consider that the US budget deficit will exceed an unthinkable $1 Trillion for a second year in a row. The national debt is now growing much faster than GDP, and servicing it is consuming an ever-increasing share of the budget. With concerns looming of a double-dip recession, meanwhile, tax revenues will probably stagnate, even regardless of what happens to spending. In short, US budget deficits are going to continue to be a fact of life for the immediate future.

Monetary Policy is equally disastrous. The Fed is pre-occupied with keeping interest rates low and with promoting an economic recovery. $2 Trillion of newly-minted money is still flowing through the system, and it’s unclear when it will be siphoned out. There are a few inflation hawks on the Fed’s Board of Governors, but they lack the power to effect a short-term change in monetary policy.

The Bank for International Settlements (BIS), G20, and a pair of economists, among others, have all sounded alarm bells, calling such policies foolish and unsustainable. According to the BIS, “Keeping interest rates very low comes at a cost—a cost that is growing with time. Experience teaches us that prolonged periods of unusually low rates cloud assessments of financial risks, induce a search for yield and delay balance-sheet adjustments.”

In short, there is a clear consensus that perennial budget deficits and low rates are wrongheaded at best, and disastrous at worst. From the standpoint of currency markets, what matters in the short-term are interest rates, and what matters in the long-term is inflation. The Dollar is in an unfavorable position on both fronts. Interest rates are currently near 0% – the lowest in the world – and easy monetary policy and high government debt increase the likelihood of inflation in the wrong-term.

In light of this notion, the only logical conclusion is that the Dollar simply plays no role in the formulation of government and Central Bank decision-making. Since the inception of the credit crisis, this was a luxury that could be afforded, as safe-haven capital poured into the US. If/when the crisis abates, this capital will probably depart, as investors are forced to consider the fundamentals.

US Apathetic about Dollar

in

Central Banks

on July 11, 2010

0 comments: