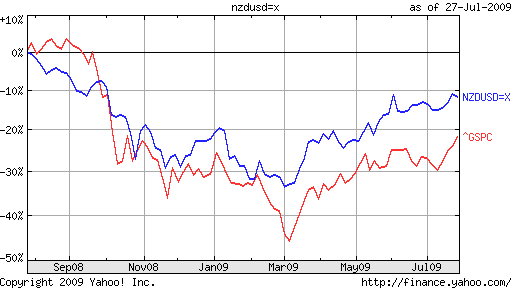

Since the inception of the financial crisis, the Dollar has been treated as a safe haven currency. Simply, when there was a surge in the level of risk-aversion, the Dollar rose proportionally. When risk aversion gave way to risk appetite, the Dollar fell. It was as simple as that.

Lately, this notion has manifested itself in the EUR/USD exchange rate, with the Euro embodying risk, and the Dollar embodying safety. In fact, a carry trading strategy has unfolded along these lines and made this phenomenon self-fulfilling: traders have taken to reflexively selling the Dollar when news is good and selling the Euro when news is bad.From my point of view, it is not the possibility of a prolonged recession that is itself noteworthy (though this is surely cause for concern), but rather that the currency markets are paying attention it. To be sure, news of the EU sovereign debt crisis continues to dominate headlines and influence investor psychology. Barring any unforeseen developments, however, this crisis probably won’t evolve much further in the short-term, and it’s logical that investors should turn their attention back to the data.

As a result, “The popular risk-related trade on the euro ‘that was prevalent in the first half of this year appears to have derailed for the time being as market players increasingly focus on comparative fundamentals once again,” summarized one trader. In fact, the Dollar has fallen by 5% over the last month, both against the Euro and on a trade-weighted basis.

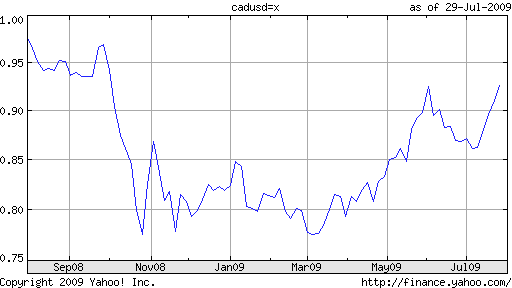

On the other side are those who argue that the US will shed its safe-haven status and become a growth currency. According to this line of thinking, the US economy will outperform the EU, Japan, and Britain – its peers/competitors in the Top Tier of currencies.

“The euro zone has been stricken by crisis over the debts of its weaker members. Japan will only emerge slowly from deflation and the U.K. has to deal with its record high budget deficit over the next few years,” argued one analyst.

As a result, “The dollar will return to a pattern seen in the early 1980s and late 1990s, when it appreciated as stocks rose…The likelihood that the dollar performs strongly rather than weakly when investors are risk-seeking will signify a major change in the currency markets.” Under this paradigm, the Japanese Yen and the Swiss Franc would probably become even further entrenched as safe-haven currencies.

Finally, it’s worth pointing out that such a paradigm shift wouldn’t necessarily be good for the Dollar. If the US is indeed able to put the recession behind it, then a renewed focus on growth fundamentals would send the Dollar higher. If the Double-Dip materializes, however, Dollar bulls will probably find themselves hoping that the Dollar can retain its safe haven status.

0 comments: