At this point, it’s cliche to point to the so-called data deluge. While once there was too little data, now there is clearly too much, and that is no less true when it comes to data that is relevant to the forex markets. In theory, all data should be moving in the same direction. Or perhaps another way of expressing that idea would be to say that all data should tell a similar story, only from different angles. In reality, we know that’s not the case, and besides, one can usually engage in the reverse scientific method to find some data to support any hypothesis. If we are serious about finding the truth and not about proving a point, then, the question is: Which data should we be looking at?

I think the quarterly Bank of International Settlements (BIS) report is a good place to start. The report is not only a great-read for data junkies, but also represents a great snapshot of the current financial and economic state of the world. It’s all macro-level data, so there’s no question of topicality. (If anything, one could argue that the scope is too broad, since data is broken down no further than US, UK, EU, and Rest of World). The best part is that all of the raw data has already been organized and packaged, and the output is clearly presented and ready for interpretation.

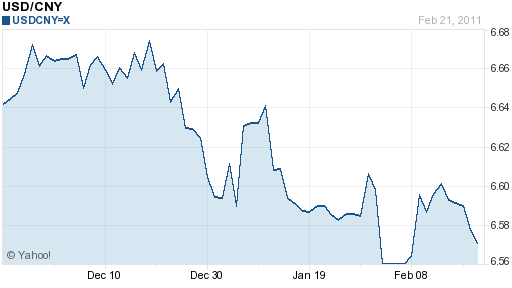

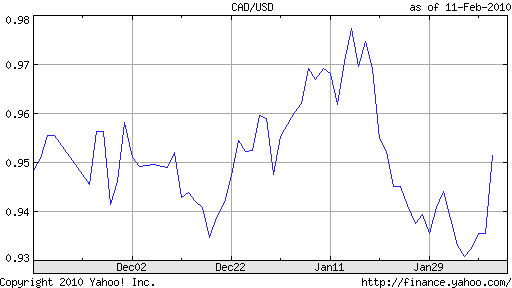

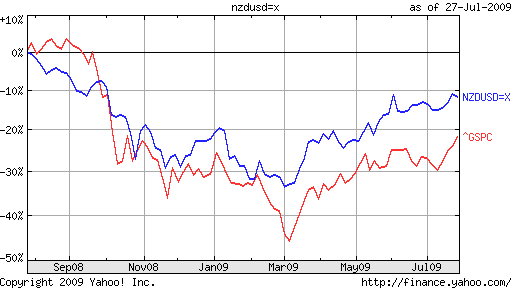

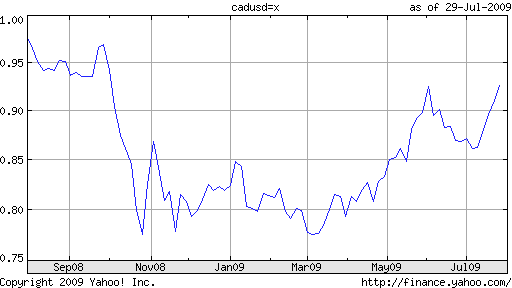

Anyway, the stock market rally that began in 2010 has showed no signs of slowing down in 2011, with the US firmly leading the rest of the world. As is usually the case, this has corresponded with an outflow of cash from bond markets and a steady rise in long-term interest rates. However, emerging market equity and bond returns have started to flag, and as a result, the flow of capital into emerging markets has reversed after a record 2010. Without delving any deeper, the implication is clear: after 2+ years of weakness, developed world economies are now roaring back, while growth in emerging markets might be slowing.

Anyway, the stock market rally that began in 2010 has showed no signs of slowing down in 2011, with the US firmly leading the rest of the world. As is usually the case, this has corresponded with an outflow of cash from bond markets and a steady rise in long-term interest rates. However, emerging market equity and bond returns have started to flag, and as a result, the flow of capital into emerging markets has reversed after a record 2010. Without delving any deeper, the implication is clear: after 2+ years of weakness, developed world economies are now roaring back, while growth in emerging markets might be slowing.

Economic growth, combined with soaring commodities prices, is already producing inflation. (See my previous post for more on this subject). However, the markets expect that the ECB, BoE, and Fed (in that order) will all raise interest rates over the next two years. As a result, while investors expect inflation to rise over the next decade, they believe it will be contained by tighter monetary policy and moderate around 2-3% in industrialized countries.

The picture for emerging market economies is slightly less optimistic, however. If you accept the BIS’s use of China, India, and Brazil as representative of emerging markets as a whole, rising interest rates will help them avoid hyperinflation, but significant price inflation is still to be expected. I wonder then if the pickup in cross-border lending over this quarter won’t slow down due to expectations of diminishing real returns.

Any sudden optimism in the Dollar and Euro (and the Pound, to a lesser extent) must be tempered, however, by their serious fiscal problems and consequent volatility. As a result of the credit crisis (and pre-existing trends), government debt has risen substantially over the last three years, topping 100% of GDP for the US and 200% of GDP for Japan. Credit default swap rates (which represent the markets’ attempt to gauge the probability of default) have risen across the board. To date, gains have been highest for “fringe” countries, but regression analysis suggests that rates for pillar economies need to rise proportionately to account for the the bigger debt burden. According to a BIS analysis, US and UK banks are very exposed to Eurozone credit risk, which means a default by one of the PIGS would reverberate around the western world.

While I worry that such a basic analysis makes me appear shallow, I stand by this “20,000 foot” approach, with the caveat that it can only be used to make extremely general conclusions. (More specific conclusions naturally demand more specific data analysis!) They are that industrialized currencies (led by the Dollar and perhaps the Euro) might stage a comeback in 2011, due to stronger economic growth and higher interest rates. While GDP growth and interest rates will undoubtedly be higher in emerging markets, investors were extremely aggressive in pricing this in. An adjustment in theoretical models naturally demands a correction in actual emerging market exchange rates!

0 comments: